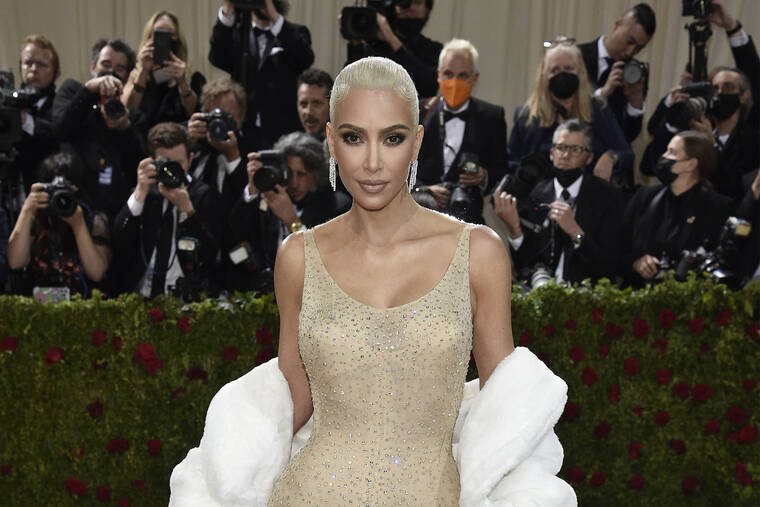

Kim Kardashian fined $1 million by SEC over crypto promotion

The long list of celebrities promoting cryptocurrencies just got shorter. Kim Kardashian is being barred from doing so for three years — and will pay a $1 million fine — to settle federal charges that she recommended a crypto security to her 330 million Instagram followers without making clear that she was paid to do so. The reality TV star also must give up the $250,000 she was paid for the Instagram post about Ethereum Max tokens, plus interest, according to a Securities and Exchange Commission settlement announced Monday. Kardashian is the latest celebrity to get ensnared in regulations that require full disclosure by people getting paid to promote financial products.

In 2020, actor Steven Seagal agreed to pay more than $300,000 as part of a similar settlement with the SEC, which also banned him from promoting investments for three years.

ADVERTISING

In 2018, the SEC settled charges against professional boxer Floyd Mayweather Jr. and music producer DJ Khaled for failing to disclose payments they received for promoting investments in a digital currency. Many celebrities and athletes regularly promote crypto through advertisements on TV and online in ways that do not violate any law. Matt Damon, Tom Brady, Reese Witherspoon and Gwyneth Paltrow are among those who have used their fame to spread enthusiasm for cryptocurrencies.

SEC Chair Gary Gensler said that the Kardashian settlement “serves as a reminder to celebrities and others that the law requires them to disclose to the public when and how much they are paid to promote investing in securities.”

Gensler also used Monday’s attention-grabbing settlement with a celebrity as an opportunity to educate the public, releasing a humorous YouTube video that warns about the potential pitfalls of investment advice doled out by the rich and famous.

“Bravo to SEC Chairman Gensler, whose action shows that no celebrity, regardless of how big or famous, that profited from pushing these risky cryptocurrency investments should be able to simply walk away,” said Adam Moskowitz, a class-action attorney currently suing Mark Cuban for promoting the company Voyager Digital before it failed. The SEC said Kardashian agreed to cooperate with an ongoing investigation, though it didn’t provide any details on that investigation.