Britain takes unprecedented step to leave EU; markets plunge

LONDON — Britain voted to leave the European Union after a bitterly divisive referendum campaign, according to tallies of official results Friday, sending global markets plunging, casting British politics into disarray and shattering the stability of a project in continental unity designed half a century ago to prevent World War III.

ADVERTISING

The decision launches a yearslong process to renegotiate trade, business and political links between the United Kingdom and what will become a 27-nation bloc, an unprecedented divorce that could take decades to complete.

“The dawn is breaking on an independent United Kingdom,” said Nigel Farage, leader of the U.K. Independence Party. “Let June 23 go down in our history as our independence day!”

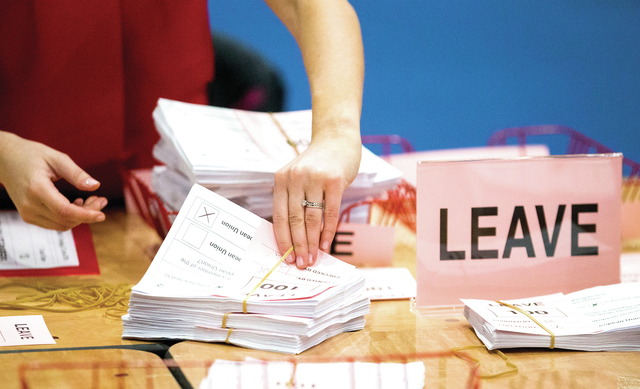

Tallies by British broadcasters of near-complete official results Friday showed the “leave” campaign winning with 52 percent of the vote. Turnout was high: 72 percent of the more than 46 million registered voters went to the polls.

Polls ahead of the vote had showed a close race, but the momentum had appeared to be on the “remain” side in the week before the vote. The result shocked investors, and stock markets plummeted around the world.

The pound suffered one of its biggest one-day falls in history, plummeting more than 10 percent in six hours, from about $1.50 to below $1.35, on concerns that severing ties with the single market will hurt the U.K. economy and undermine London’s position as a global financial center.

The U.K. would be the first major country to leave the EU, which was born from the ashes of World War II as European leaders sought to build links and avert future hostility. With no precedent, the impact on the single market of 500 million people — the world’s largest economy — is unclear.

As results poured in, a picture emerged of a sharply divided nation: Strong pro-EU votes in the economic and cultural powerhouse of London and semi-autonomous Scotland were countered by sweeping anti-Establishment sentiment for an exit across the rest of England, from southern seaside towns to rust-belt former industrial powerhouses in the north.

“A lot of people’s grievances are coming out and we have got to start listening to them,” said deputy Labour Party leader John McDonnell.

The vote is likely to cost Prime Minister David Cameron his job. The leader of the ruling Conservative Party called the referendum largely to silence voices to his right, then staked his reputation on keeping Britain in the EU. Former London Mayor Boris Johnson, who is from the same party, was the most prominent supporter of the “leave” campaign and now becomes a leading contender to replace Cameron.

After winning a majority in Parliament in the last election, Cameron negotiated a package of reforms that he said would protect Britain’s sovereignty and prevent EU migrants from moving to the U.K. to claim generous public benefits.

Critics charged that those reforms were hollow, leaving Britain at the mercy of bureaucrats in Brussels and doing nothing to stem the tide of European immigrants who have come to the U.K. since the EU expanded eastward in 2004. The “leave” campaign accuses the immigrants of taxing Britain’s housing market, public services and employment rolls.

Those concerns were magnified by the refugee crisis of the past year that saw more than 1 million people from the Middle East and Africa flood into the EU as the continent’s leaders struggled to come up with a unified response.

Cameron’s efforts to find a slogan to counter the “leave” campaign’s emotive “take back control” settled on “Brits don’t quit.” But the appeal to a Churchillian bulldog spirit and stoicism proved too little, too late.

The slaying of pro-Europe lawmaker Jo Cox a week before the vote brought a shocked pause to both campaigns and appeared to shift momentum away from the “leave” camp. While it isn’t clear whether her killer was influenced by the EU debate, her death aroused fears that the referendum had stirred demons it would be difficult to subdue.

The result triggers a new series of negotiations that is expected to last two years or more as Britain and the EU search for a way to separate economies that have become intertwined since the U.K. joined the bloc on Jan. 1, 1973. Until those talks are completed, Britain will remain a member of the EU.

Exiting the EU involves taking the unprecedented step of invoking Article 50 of the EU’s governing treaty. While Greenland left an earlier, more limited version of the bloc in 1985, no country has ever invoked Article 50, so there is no roadmap for how the process will work.

Authorities ranging from the International Monetary Fund to the U.S. Federal Reserve and the Bank of England have warned that a British exit will reverberate through a world economy that is only slowly recovering from the global economic crisis.

“It will usher in a lengthy and possibly protracted period of acute economic uncertainty about the U.K.’s trading arrangements,” said Daniel Vernazza, the U.K. economist at UniCredit.

The European Union is the world’s biggest economy and the U.K.’s most important trading partner, accounting for 45 percent of exports and 53 percent of imports.

In addition, the complex nature of Britain’s integration with the EU means that breaking up will be hard to do. The negotiations will go far beyond tariffs, including issues such as cross-border security, foreign policy cooperation and a common fisheries policy.

Among the biggest challenges for Britain is protecting the ability of professionals such as investment managers, accountants and lawyers to work in the EU.

As long as the U.K. is a member of the bloc, firms registered in Britain can operate in any other member state without facing another layer of regulation. It’s the same principle that allows exporters to ship their goods to any EU country free of tariffs.

Now that right is up for negotiation, threatening the City, as London’s financial heart is known, and its position as Europe’s pre-eminent financial center.

Many international banks and brokerages have long used Britain as the entry point to the EU because of its trusted legal system and institutions that operate in English, the language of international finance. Britain’s financial services industry is also surrounded by an ecosystem of expertise — lawyers, accountants and consultants— that support it.

Some 60 percent of all non-EU firms have their European headquarters in the U.K., according to TheCityUK, which lobbies on behalf of the financial industry. The U.K. hosts more headquarters of non-EU firms than Germany, France, Switzerland and the Netherlands put together.

“We believe this outcome has serious implications for the City and many of our clients’ businesses with exposure to the U.K. and the EU,” said Malcolm Sweeting, senior partner of the law firm, Clifford Chance. “We are working alongside our clients to help them as they anticipate, plan for and manage the challenges the coming political and trade negotiations will bring.”

JPMorgan Chase Chief Executive Jamie Dimon said earlier this month that a vote to leave would force his bank to move jobs to mainland Europe to ensure that it could continue to service clients in the EU. Other global businesses with customers in the rest of the EU will be in a similar situation.

The only question that remains is whether the dire economic predictions economists made during the campaign will come to pass.

“Uncertainty is bad for business,” Vernazza said. “A sharp fall in U.K. risky asset prices, delays to investment, disruption to trade, and a loss of business and consumer confidence mean the U.K. economy is more likely than not to enter a technical recession within two years.”